Once again, the following is my modest personal perception... I'm still thinking that politicians, politics, financial markets and therefore the public who uses financial products and services, don't exactly get along will: I can see the case of Elizabeth Warren (President Obama's choice to head the Consumer Financial Protection Bureau) as the latest example of some politicians (Republican Representative Patrick McHenry calling her a "liar" during a hearing last month) creating what I could define as "obstacles" intended (in the end?) to make things difficult for the public to become more financially literate.

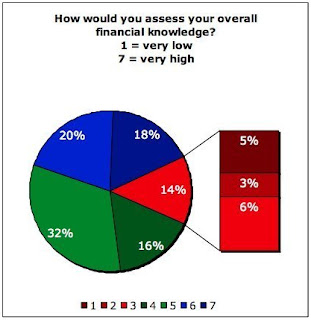

Once again, the following is my modest personal perception... I'm still thinking that politicians, politics, financial markets and therefore the public who uses financial products and services, don't exactly get along will: I can see the case of Elizabeth Warren (President Obama's choice to head the Consumer Financial Protection Bureau) as the latest example of some politicians (Republican Representative Patrick McHenry calling her a "liar" during a hearing last month) creating what I could define as "obstacles" intended (in the end?) to make things difficult for the public to become more financially literate.Even though key tools such as the Financial Literacy and Education Commission and events such as the Financial Literacy Month are good educational and informational tools intended to introduce consumers to the basics by issuing a series of feasible national strategies about promoting financial literacy, based on several recent studies, (particularly a very interesting one from the Financial Literacy and Education Commission itself) we continue witnessing the same combination of educational - financial - emotional problems focused on people getting increasingly indebted without realizing the scope of the problem they are grappling with; they still don't understand basic financial concepts involving savings, mortgages, credit cards and therefore the unexpected notion about being indebted and risking foreclosure and bankruptcy; in this regard, The Huffington Post also published the following chart analyzing the current level of financial literacy in America:

After other studies have documented a relationship between emotions and money, even though I believe that shrinks are not exactly the "ideal" counselor (I met two of them on line that confirmed my personal skepticism about their professional reliability), Financial Psychologist Brad Klonts recently argued that overexposing kids to money problems could be a "bad idea"; I felt somehow impelled to disagree with his perspective since it looked rather contradictory.

In this regard, authors like Alonzo Peters and Stress Less Boise among others argued on the other hand that as long as parents cope intelligently with a very understandable feeling of anxiety because of their need to stretch shrinking family budgets while they find and receive a more suitable support and concrete information (for example) from community financial counselors, they should be perfectly capable -on a more financially responsible basis- to make kids feel relaxed and assured by teaching (rather than exposing) them that they are not "responsible" for what could have happened to their parents in the event of being laid off (by using the most appropriate language according to their age) in order to make them start to understand the importance of money rather than using them to express their anger about their financial problems.

Let's consider the following videos that can validate my own perspective as to the critical importance for newlyweds to be not only absolutely compatible as to their long term commitment to spend a life together but to become -when the time arrives- fully responsible parents - compatible "financial planners" for their own financial -and particularly their children's- emotional well being:

No comments:

Post a Comment